401(k) vs. Roth 401(k): What’s the Difference?

When it comes to saving for retirement, your employer-sponsored 401(k) plan is one of the most powerful tools available. But did you know you may have two options: a traditional 401(k) and a Roth 401(k)? Understanding the differences can help you make informed decisions about your financial future.

What Is a Roth 401(k)?

A Roth 401(k) works much like a traditional 401(k) in that you can defer part of your salary into the plan to save for retirement. However, there’s one key distinction: tax treatment.

- Traditional 401(k): Contributions are made before taxes, reducing your taxable income today. You’ll pay taxes later when you withdraw the money in retirement.

- Roth 401(k): Contributions are made after taxes, meaning you pay income tax now. The big advantage? Qualified withdrawals in retirement are tax-free.

Key Features of the Roth 401(k)

- Contributions are taxed in the year you make them.

- Roth contributions are kept separate from pretax 401(k) funds.

- You can roll Roth 401(k) money directly into a Roth IRA.

- You decide how much of your contribution goes to Roth vs. traditional.

- You can combine both types of contributions to reach the IRS annual limit.

Employer Matching Contributions

Yes, you can still receive your employer’s match! However, all employer contributions will remain pretax, even if you choose Roth for your own deferrals.

How Are Distributions Treated?

Qualified Roth 401(k) withdrawals are tax-free, provided:

- You’ve met the five-year holding requirement.

- You satisfy any additional plan-specific rules.

Additional Benefits of a Roth 401(k)

- No income restrictions: Unlike a Roth IRA, anyone can contribute to a Roth 401(k), regardless of income.

- Higher contribution limits: Roth 401(k)s allow you to save more tax-free than a Roth IRA.

- Investment flexibility: Rolling into a Roth IRA later can open up more investment choices.

Which Option Is Right for You?

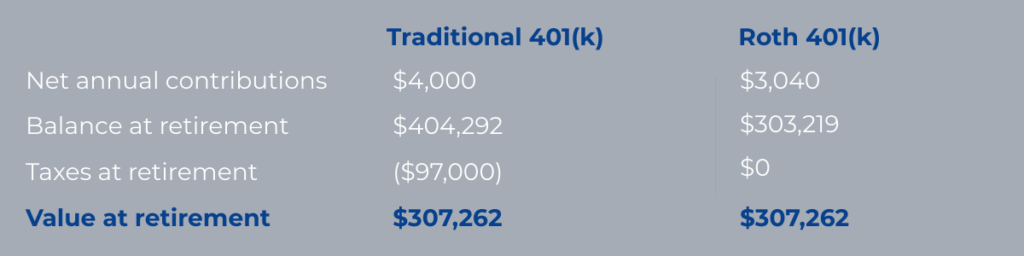

Here’s an example:

- Age: 35

- Salary: $40,000

- Tax bracket: 24%

- Contribution: 10% of salary

If you keep your take-home pay the same, Roth contributions will be smaller because you’re paying taxes upfront. But at retirement, both accounts could end up with the same after-tax value.

Scenario 1: Same Take-Home Pay

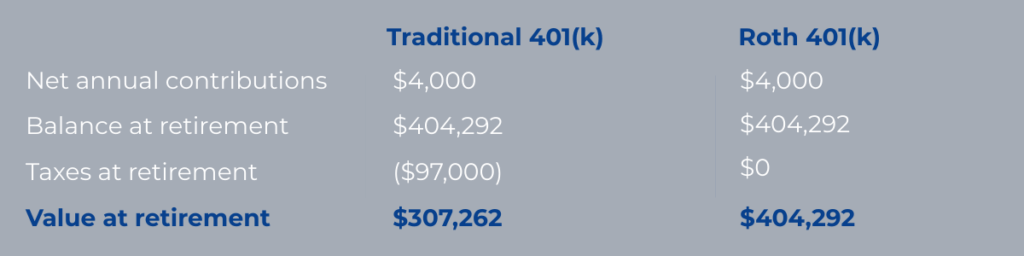

If you increase your paycheck deductions and reduce your take-home pay, your net contribution to the Roth 401(k) would be the same as your contribution to a traditional 401(k).

Scenario 2: Reduced Take-Home Pay (Equal Contributions)

*Assumptions:

- 7 percent annual growth rate; contributions are made at the beginning of the year.

- You are investing savings from pretax deferrals, and the savings are growing at the same rate as the 401(k0 contributions.

- These illustrations do not account for any increase in salary or bonuses you may receive.

- You are paying the income taxes due on the Roth 401(k) deferrals each year. This example also does not account for any complex tax situation you may have.

Bottom Line

If you expect to be in a higher tax bracket in retirement—or simply want the peace of mind of tax-free withdrawals—the Roth 401(k) can be a smart choice. If you prefer to lower your taxable income today, a traditional 401(k) might suit you better. Many savers choose to split contributions between both for flexibility.

Q&A

Who is eligible to make contributions to a Roth 401(k)?

If you are eligible to contribute to your 401(k) plan and your plan permits them, you can make Roth 401(k) contributions.

Can I have a Roth IRA and make Roth 401(k) contributions to my 401(k) plan?

Yes. If eligible, you may contribute to a Roth IRA and a Roth 401(k) option in an employer-sponsored retirement plan within the limits established by the IRS annually.

Can I make both regular 401(k) contributions and Roth 401(k) contributions at the same time?

Yes. Your contributions can be made up entirely of regular (pretax) contributions, entirely of Roth (after-tax) contributions, or a combination of the two. Your plan’s recordkeeper will maintain separate accounting for these two types of contributions.

Will distributions of my Roth 401(k) contributions be nontaxable?

The distribution of your contributions will be tax free, since you already paid income tax on the them when they were made to the plan.

In order for the earnings on those contributions to be tax free, they must be distributed only after you reach age 59 ½, you become disabled, or your death. Also, your Roth 401(k) contributions must have been in the plan for at least five years from when you first made a Roth 401(k) contribution.

When does the five-year period start?

The five-year period begins on the first day of the year in which you make your first Roth 401(k) contribution. Contributions made in a later year do not start a new five-year waiting period.

Will I have to take required distributions of my Roth 401(k) contributions beginning at age 73?

No. Roth 401(k) plans are not subject to mandatory distribution requirements.

Want to learn more about which option fits your goals? Contact us today to discuss your retirement strategy.

__________________________________________________________________________

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

The hypothetical examples above are for illustrative purposes only. No specific investments were used in these examples. Actual results will vary. Past performance does not guarantee future results.

If you are considering rolling over money from an employer-sponsored plan, you often have the following options: leave the money in the current employer-sponsored plan, move it into a new employer-sponsored plan, roll it over to an IRA, or cash out the account value. Leaving money in a plan may provide special benefits including access to lower-cost investment options; educational services; potential for penalty-free withdrawals; protection from creditors and legal judgments; and the ability to postpone required minimum distributions. If your plan account holds appreciated employer stock, there may be negative tax implications of transferring the stock to an IRA. Whether to roll over your plan account should be discussed with your financial advisor and your tax professional.

Authored in part by the Strategic Retirement Solutions team at Commonwealth Financial Network® and Axial Financial Group.

©2026 Axial Financial Group and Commonwealth Financial Network.