Investing in an Election Year: Three things to keep in mind

Investing during an election year can be tough on the nerves, and 2024 promises to be no different. Politics can bring out strong emotions and biases, but investors would be wise to put these aside when making investment decisions.

Benjamin Graham, the father of value investing, famously noted that “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” He wasn’t literally referring to the intersection of elections and investing, but he could have been. Markets can be especially choppy during election years, with sentiment often changing as quickly as candidates open their mouths.

Graham first made his analogy in 1934, in his seminal book, “Security Analysis.” Since then there have been 23 election cycles, and we’ve analyzed them all to help you and your clients prepare for investing in these potentially volatile periods. Below we highlight three common mistakes made by investors in election years and offer ways to avoid these pitfalls and invest with confidence in 2024.

Mistake #1: Investors worry too much about which party wins the election

There’s nothing wrong with wanting your candidate to win, but investors can run into trouble when they place too much importance on election results. That’s because elections have, historically speaking, made essentially no difference when it comes to long-term investment returns.

“Presidents get far too much credit, and far too much blame, for the health of the U.S. economy and the state of the financial markets,” says Capital Group economist Darrell Spence. “There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.”

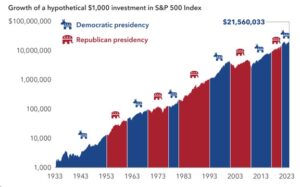

What should matter more to investors is staying invested. Although past results are not predictive of future returns, a $1,000 investment in the S&P 500 Index made when Franklin D. Roosevelt took office would have been worth almost $22 million today. During this time there have been eight Democratic and seven Republican presidents. Getting out of the market to avoid a certain party or candidate in office could have severely detracted from an investor’s long-term returns.

By design, elections have clear winners and losers. But the real winners were investors who avoided the temptation to base their decisions around election results and stayed invested for the long haul.

Stocks have trended higher regardless of which party has been in office

Sources: Capital Group, Morningstar, Standard & Poor’s. As of December 31, 2023. Dates of party control are based on inauguration dates. Values are based on total returns in USD. Shown on a logarithmic scale. Past results are not predictive of results in future periods.

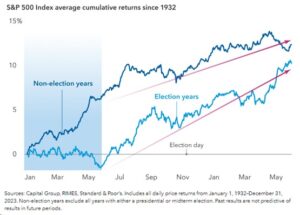

Mistake #2: Investors get spooked by primary season volatility

Markets hate uncertainty, and what’s more uncertain than primary season of an election year? That said, volatility caused by this uncertainty is often short-lived. After the primaries are over and each party has selected its candidate, markets have tended to return to their normal upward trajectory.

Markets often bounced back after the volatility of primary season

Sources: Capital Group, RIMES, Standard & Poor’s. Includes all daily price returns from January 1, 1932–December 31, 2023. Non-election years exclude all years with either a presidential or midterm election. Past results are not predictive of results in future periods.

Election year volatility can also bring select buying opportunities. Policy proposals during primaries often target specific industries, putting pressure on share prices. The health care sector has been in the crosshairs for a number of election cycles. Heated rhetoric over drug pricing put pressure on many stocks in the pharmaceutical and managed care industries. Other sectors have had similar bouts of weakness prior to elections.

Does that mean you should avoid specific sectors altogether? Not according to Rob Lovelace, an equity portfolio manager with 38 years of experience investing through many election cycles. “When everyone is worried that a new government policy is going to come along and destroy a sector, that concern is usually overblown,” Lovelace says.

Regardless of who wins, stocks with strong long-term fundamentals have often rallied once the campaign spotlight fades. This pre-election market turbulence can create buying opportunities for investors with a contrarian point of view and the strength to tolerate what could be short-term volatility.

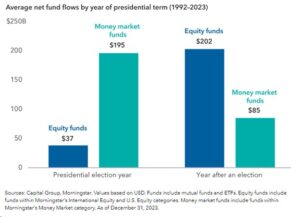

Mistake #3: Investors try to time the markets around politics

If you’re nervous about the markets in 2024, you’re not alone. Presidential candidates often draw attention to the country’s problems, and campaigns regularly amplify negative messages. So maybe it should be no surprise that investors have tended to be more conservative with their portfolios ahead of elections.Since 1992, investors have poured assets into money market funds — traditionally one of the lowest risk investment vehicles — much more often leading up to elections. By contrast, equity-focused mutual funds have seen the highest net inflows in the year immediately after an election. This suggests that investors may prefer to minimize risk during election years and wait until after uncertainty has subsided to revisit riskier assets like stocks.

Investors have tended to be more cautious leading up to elections

Sources: Capital Group, Morningstar. Values based on USD. Funds include mutual funds and ETFs. Equity funds include funds within Morningstar’s International Equity and U.S. Equity categories. Money market funds include funds within Morningstar’s Money Market category. As of December 31, 2023.

But market timing is rarely a winning long-term investment strategy, and it can pose a major problem for portfolio returns. To verify this, we analyzed investment returns over the last 23 election cycles to compare three hypothetical investment approaches: being fully invested in equities, making monthly contributions to equities, or staying in cash until after the election. We then calculated the portfolio returns after each cycle, assuming a four-year holding period.

The hypothetical investor who stayed in cash until after the election had the worst outcome of the three portfolios in 17 of 23 periods. Meanwhile, investors who were fully invested or made monthly contributions during election years came out on top. These investors had higher average portfolio balances over the full period and more often outpaced the investor who stayed on the sidelines longer.

Sticking with a sound long-term investment plan based on individual investment objectives is usually the best course of action. Whether that strategy is to be fully invested throughout the year or to consistently invest through a vehicle such as a 401(k) plan, the bottom line is that investors should avoid market timing around politics. As is often the case with investing, the key is to put aside short-term noise and focus on long-term goals.

How can investors avoid these mistakes?

- Don’t allow election predictions and outcomes to influence investment decisions. History shows that election results have very little impact on long-term returns.

- Expect volatility, especially during primary season, but don’t fear it. View it as a potential opportunity.

- Stick to a long-term investment strategy instead of trying to time markets around elections. Investors who were fully invested or made regular, monthly investments would have done better than those who stayed in cash in election years.

Rob Lovelace is an equity portfolio manager and chair of Capital International, Inc. He has 38 years of investment experience (as of 12/31/2023). He holds a bachelor’s degree in mineral economics from Princeton University. He also holds the Chartered Financial Analyst® designation.

Darrell R. Spence covers the United States as an economist and has 31 years of industry experience (as of 12/31/2023). He holds a bachelor’s degree in economics from Occidental College. He also holds the Chartered Financial Analyst® designation and is a member of the National Association for Business Economics.

The accompanying pages have been developed by an independent third party. Commonwealth Financial Network® is not responsible for their content and does not guarantee their accuracy or completeness, and they should not be relied upon as such. These materials are general in nature and do not address your specific situation. For your specific investment needs, please discuss your individual circumstances with your representative. Commonwealth does not provide tax or legal advice, and nothing in the accompanying pages should be construed as specific tax or legal advice. Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services offered through Axial Financial Group are separate and unrelated to Commonwealth.